Senior Housing for Taguig City, Philippines

Overview

Development Master Plan:

Mid-Rise Senior Housing Project Study at the Food Terminal Complex

- Site Development Design

- Financial Model

- Public-Private Partnership Deal Structure

Public-Private Partnership Development:

Lanebrook submitted a study to Food Terminal, Inc. (FTI), a resort-type retirement development for active seniors. The project is a promising product as it addresses the needs of the global aging population, which is expected to grow to 1 billion people by the year 2030 or about twelve percent (12%) of the earth’s inhabitants. In addition, it banks on the capabilities of local talents to offer special Filipino care for the elderly with a tender loving smile, which is wanting in other cultures. As word gets around about our differentiated service-oriented development, we hope that we will be able to help position the Philippines as one of the top retirement destinations around the world, with FTI pioneering the cause.

Development Approach:

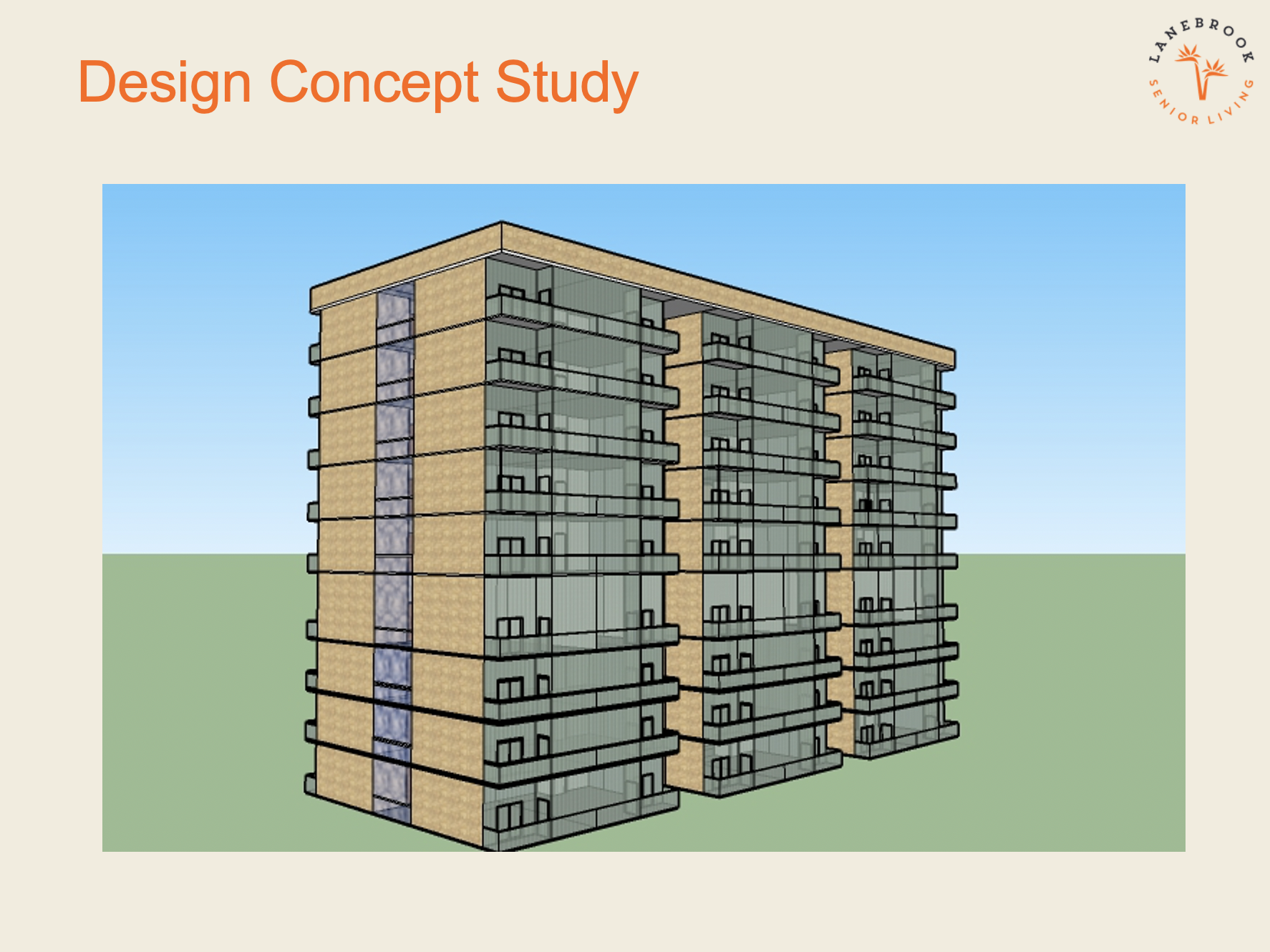

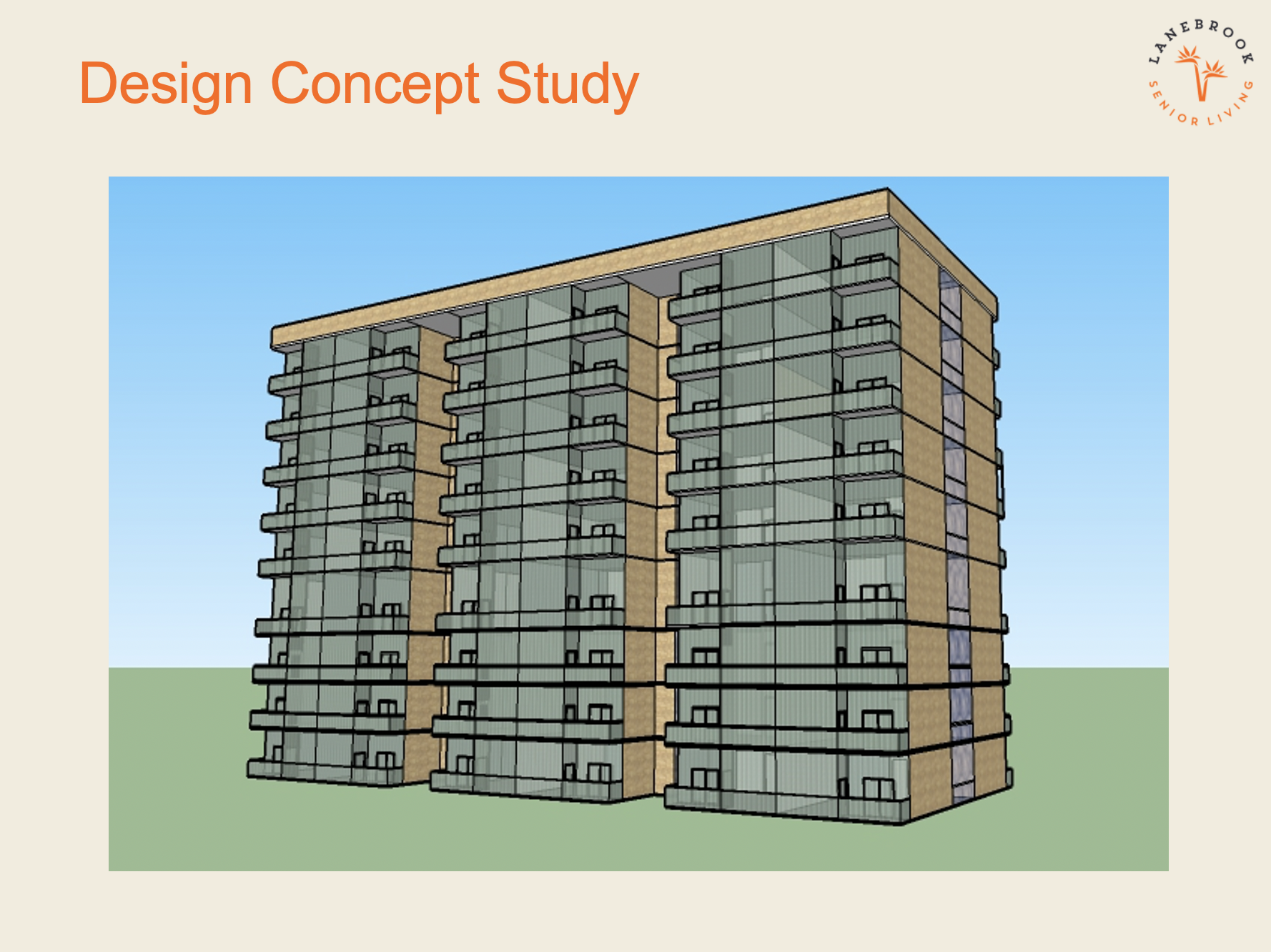

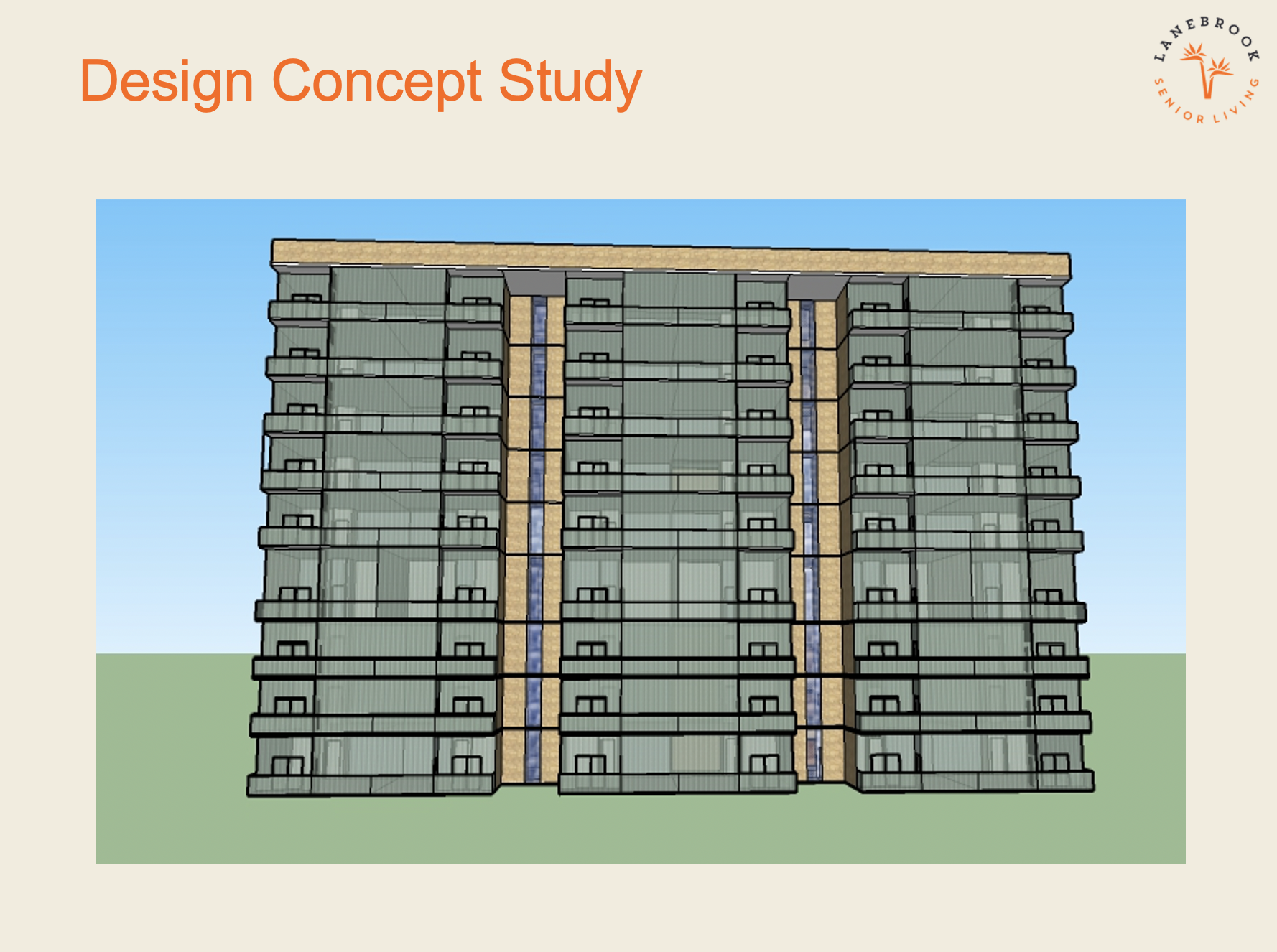

We proposed the redevelopment of the land where the existing FTI administration building is located as a start-up area with an option to increase the project area to other FTI parcels available for development. This project can be a test product for FTI as a retirement location for possible expansion in the other FTI parcels, which give high-value recurring rental income. At the same time, FTI maintains the ownership of the land long-term. Aside from the real estate product cluster units, which will be in 15 -16 stories medium rise development, the project will be service-oriented and designed to meet the needs of seniors and retirees, a new concept for senior retirement villages in the Philippines. It intends to make the move to a retirement village an enjoyable and comfortable transitional experience for seniors.

Project Concept:

The project will include services similar to senior facilities abroad – with concierge and maintenance and other services available 24/7. For example, to address more specific needs of the target market (at least 55 years old; foreigners, balikbayans, or locals), there will be an events planner to ensure a full calendar of activities every month. There will also be a pool of nurses and consultants for diet, wellness, and health to make the residents feel safe and secure, knowing that help is just a phone call or panic button away. All these services will be implemented through a professional property management company to ensure smooth day-to-day operations and timely collection of rents and association dues, the project’s lifeline. All these services will be available throughout the term of the lease with the clients.

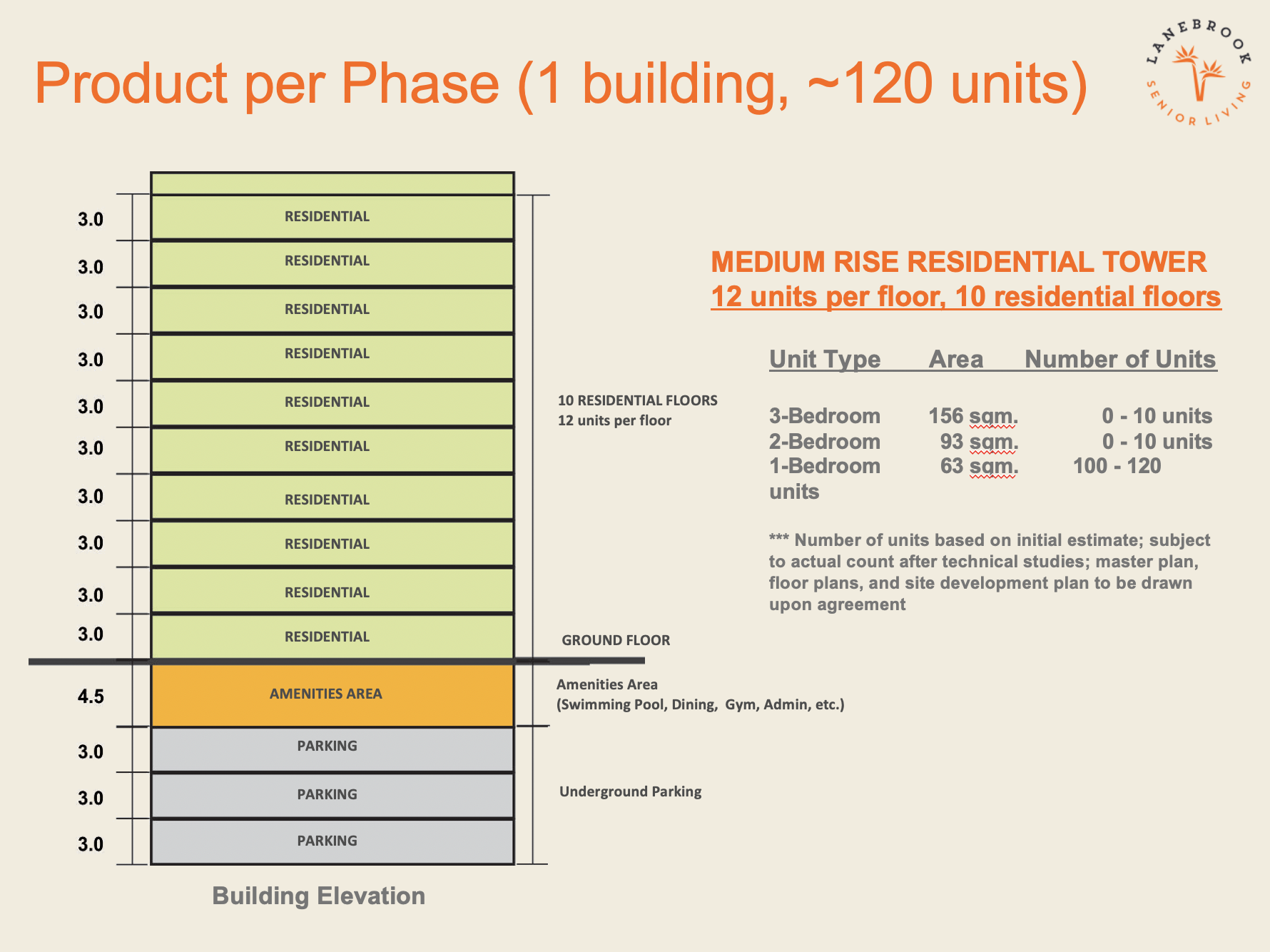

Our proposed concept will require a phased development, at least 120 units per building for each development cluster/Phase. This project size will allow us to develop a good mix of unit types: 1-bedroom (63 sqm.), 2-bedroom (93 sqm), and 3-bedroom (156 sqm.) units. A sizeable number of residents is required to form an economically and viable homeowner’s association with affordable dues to pay for its day-to-day operations and maintenance of its amenities.

All units will be designed to address the needs of aging dwellers such as having no steps within the unit, wide doors, and big toilets to accommodate wheelchairs in the future and panic buttons for peace of mind. They will be finished units, ready for move-in; dwellers will have to bring in their own furniture, appliances, and other household needs.

Amenities will be located on the podium on the 5th floor, while the ground floor will be for some services/retail space and the 2nd to the 4th will be for parking. The plan will include walking paths, exercise and wellness stations spread, community gardens, clubhouse, pet areas, rooms for indoor activities, and gym, wherever possible to put them. We will also provide other facilities like adult and kiddy pools, playground equipment, barbeque/picnic areas to encourage frequent visits from family members and friends.

Proposed Development Options:

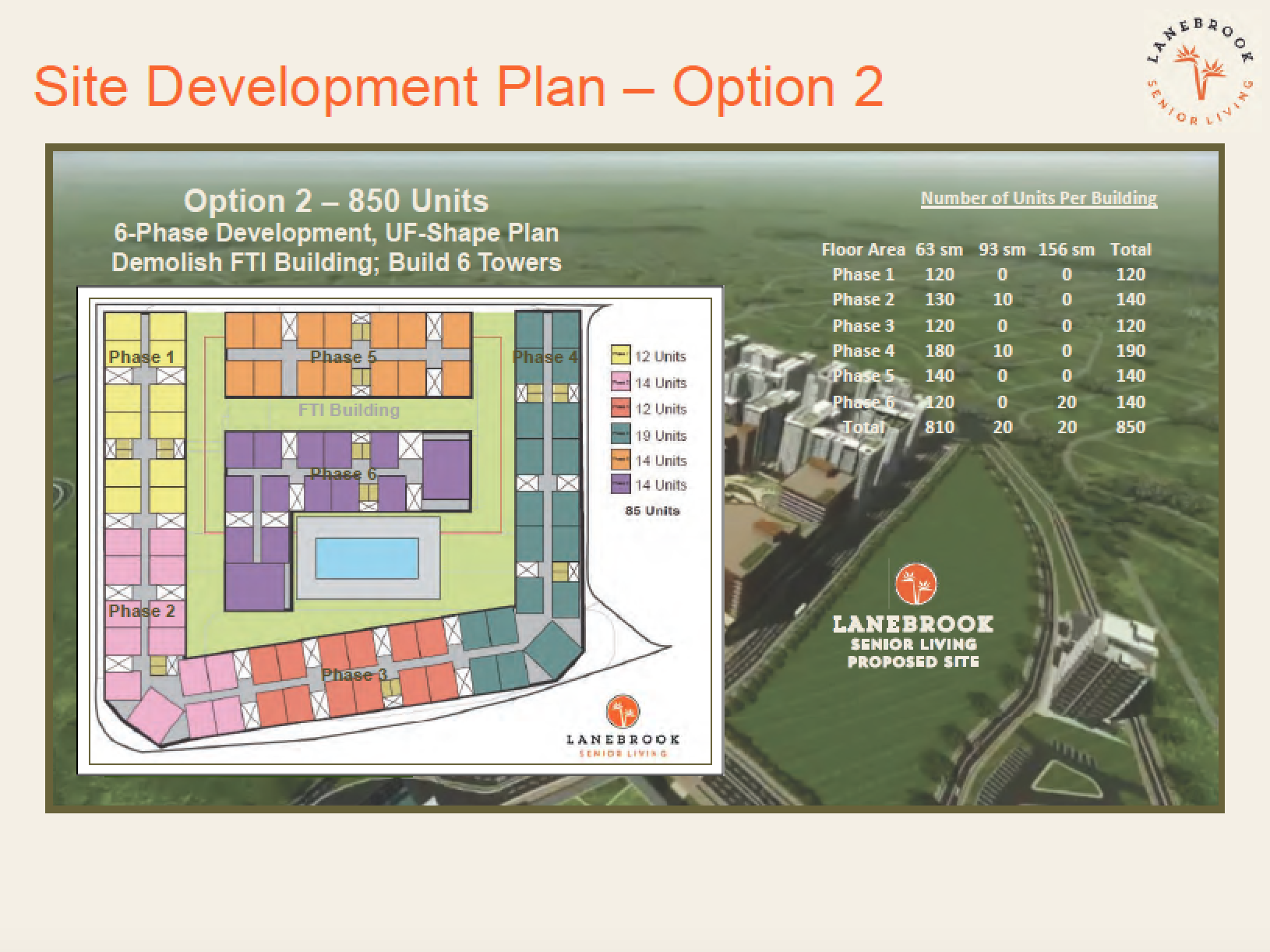

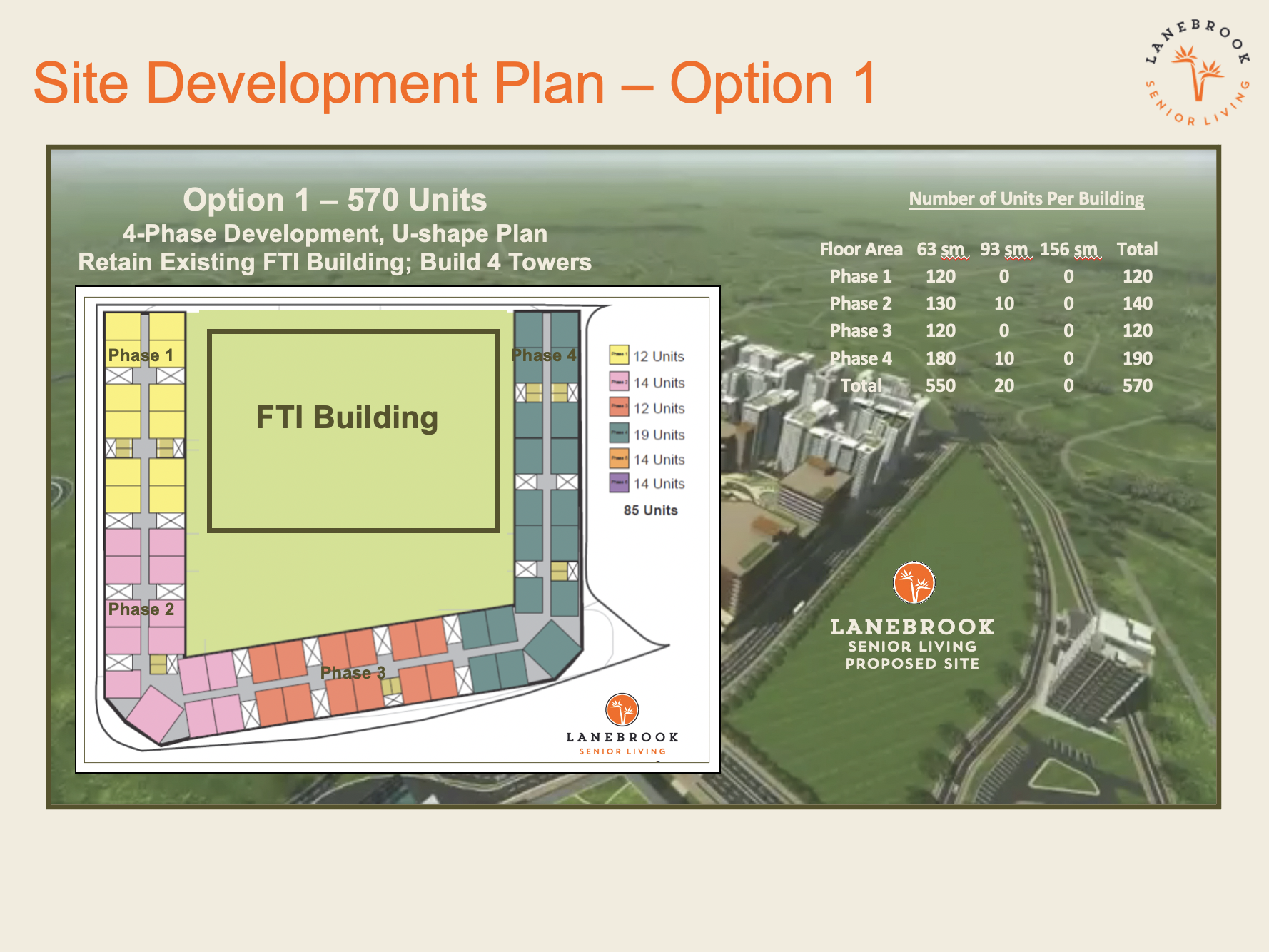

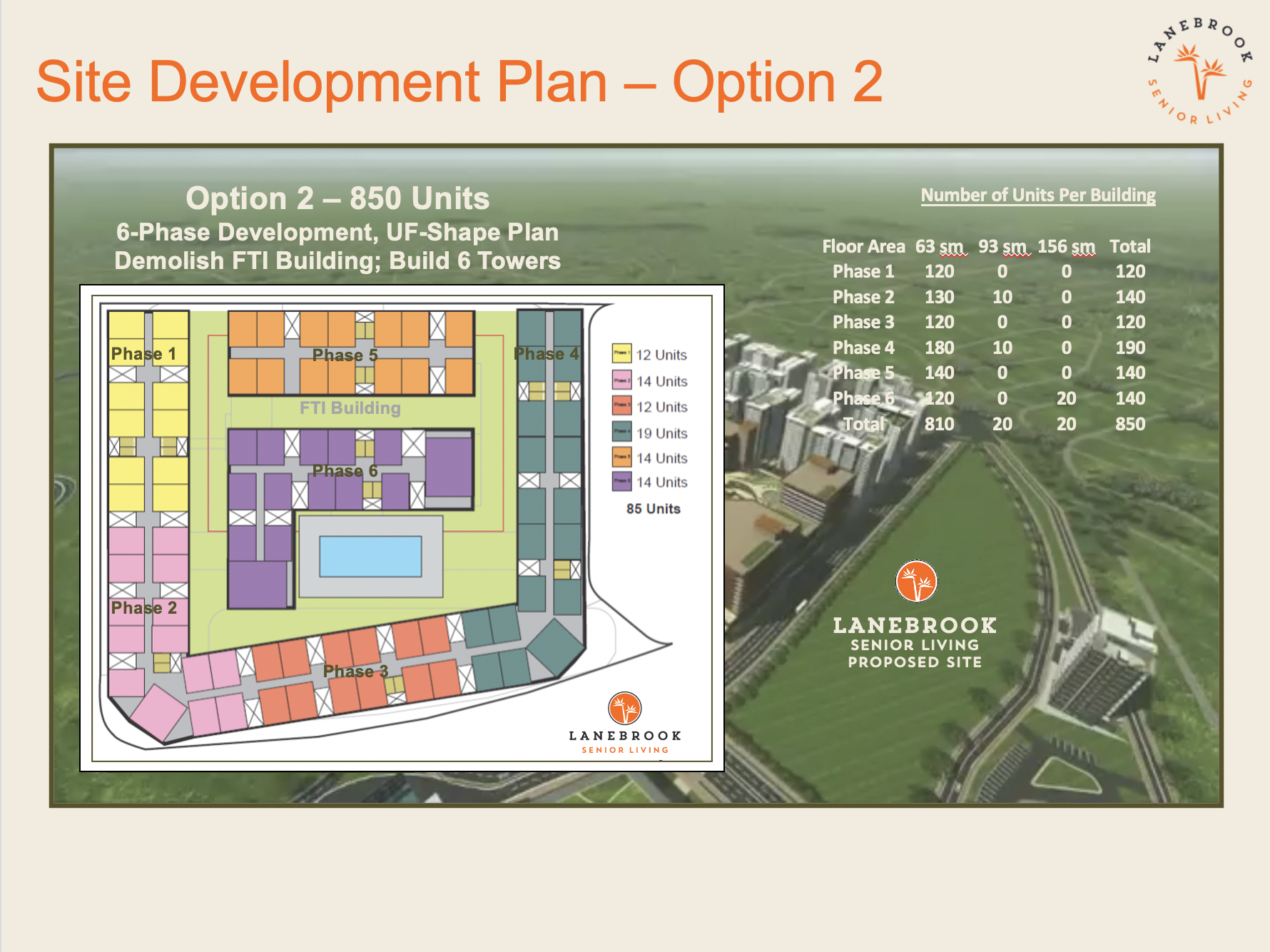

We offered two (2) development options:

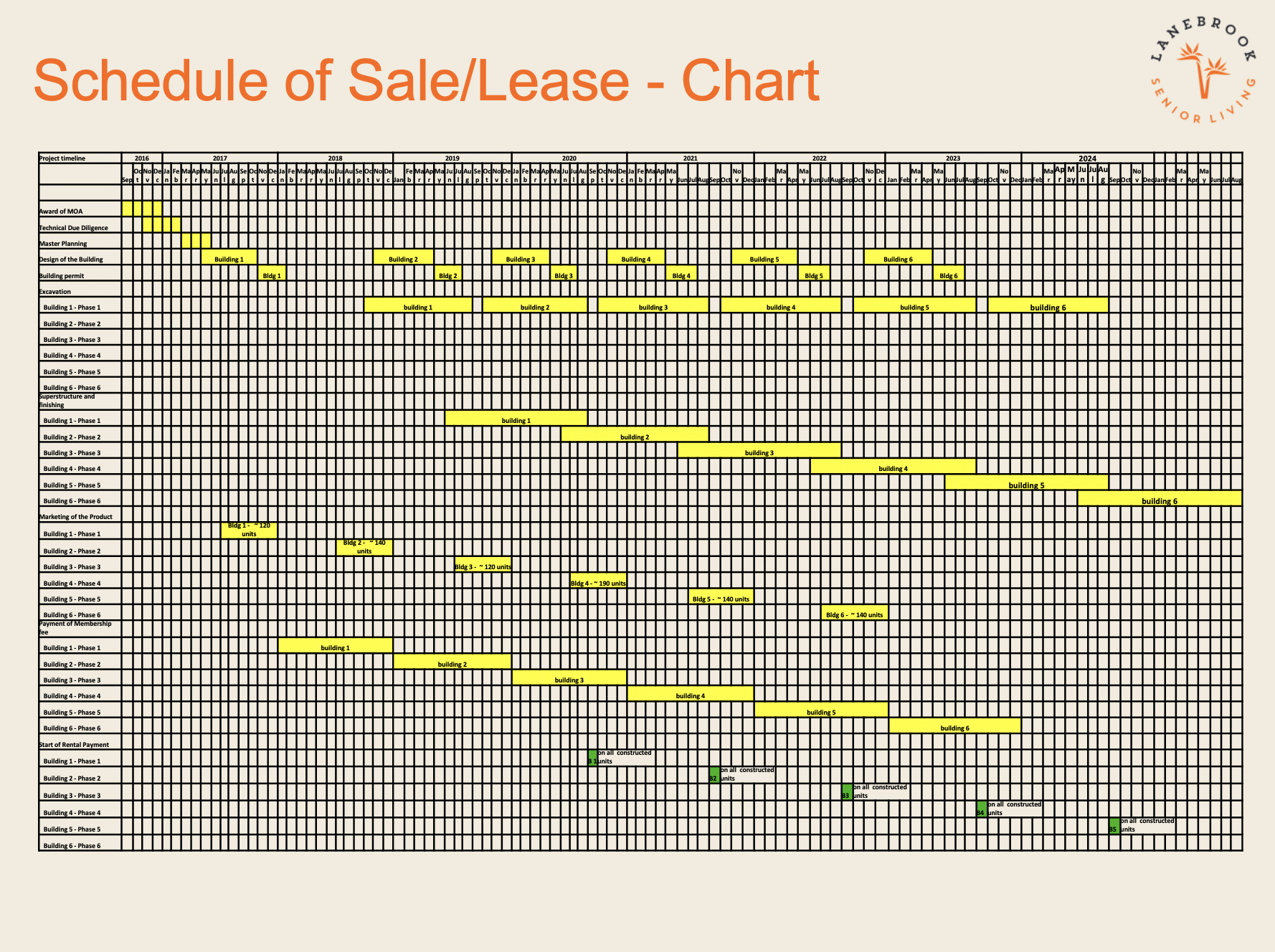

Option 1: (in 4 Phases – 1 building per Phase) retains the existing FTI Admin Building with 570 units.

Option 2: (in 6 Phases – 1 building per Phase) will require the said Admin Building to be torn down for the later phase of the development, after Phase 3 launch with 850 units.

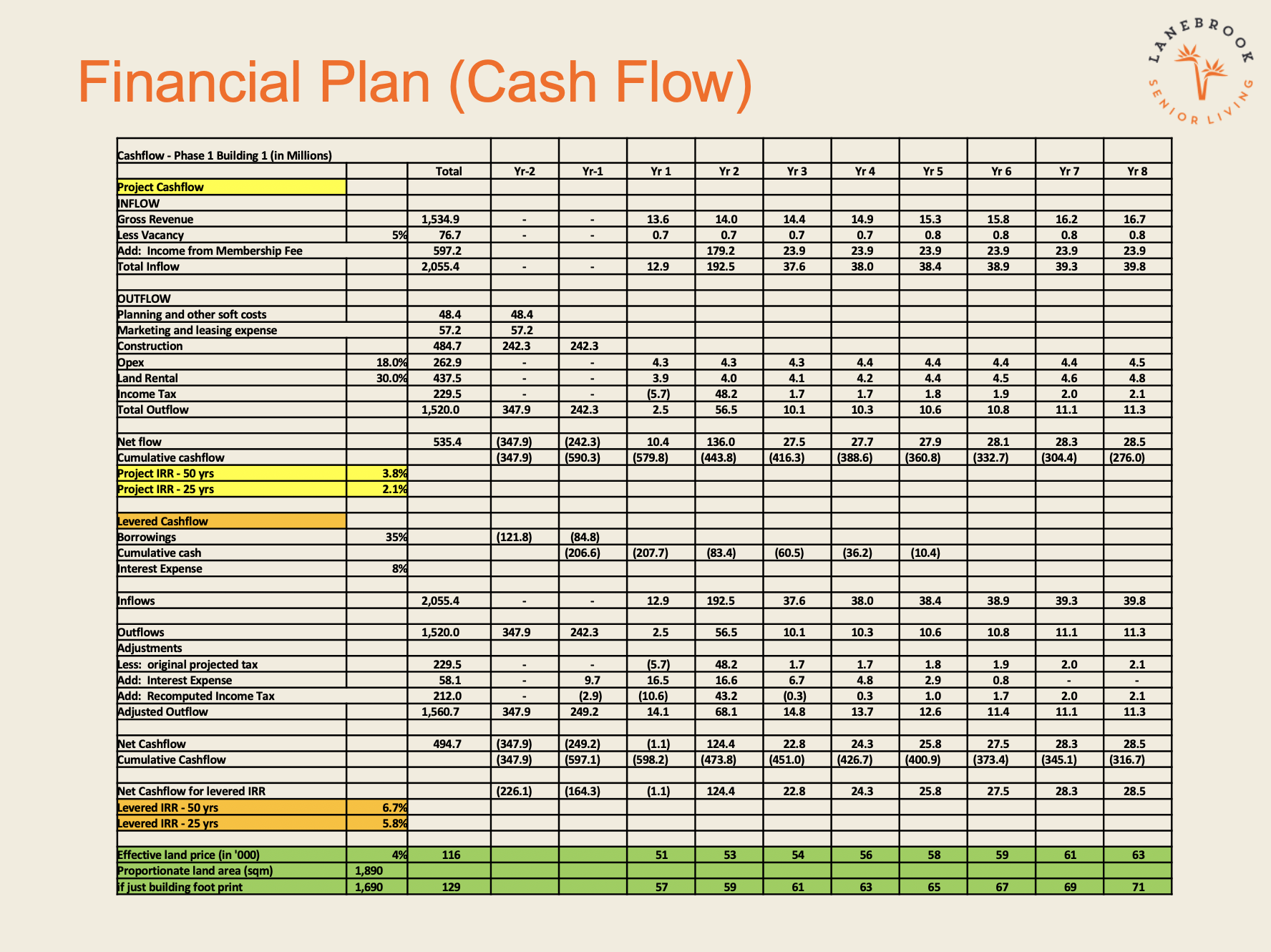

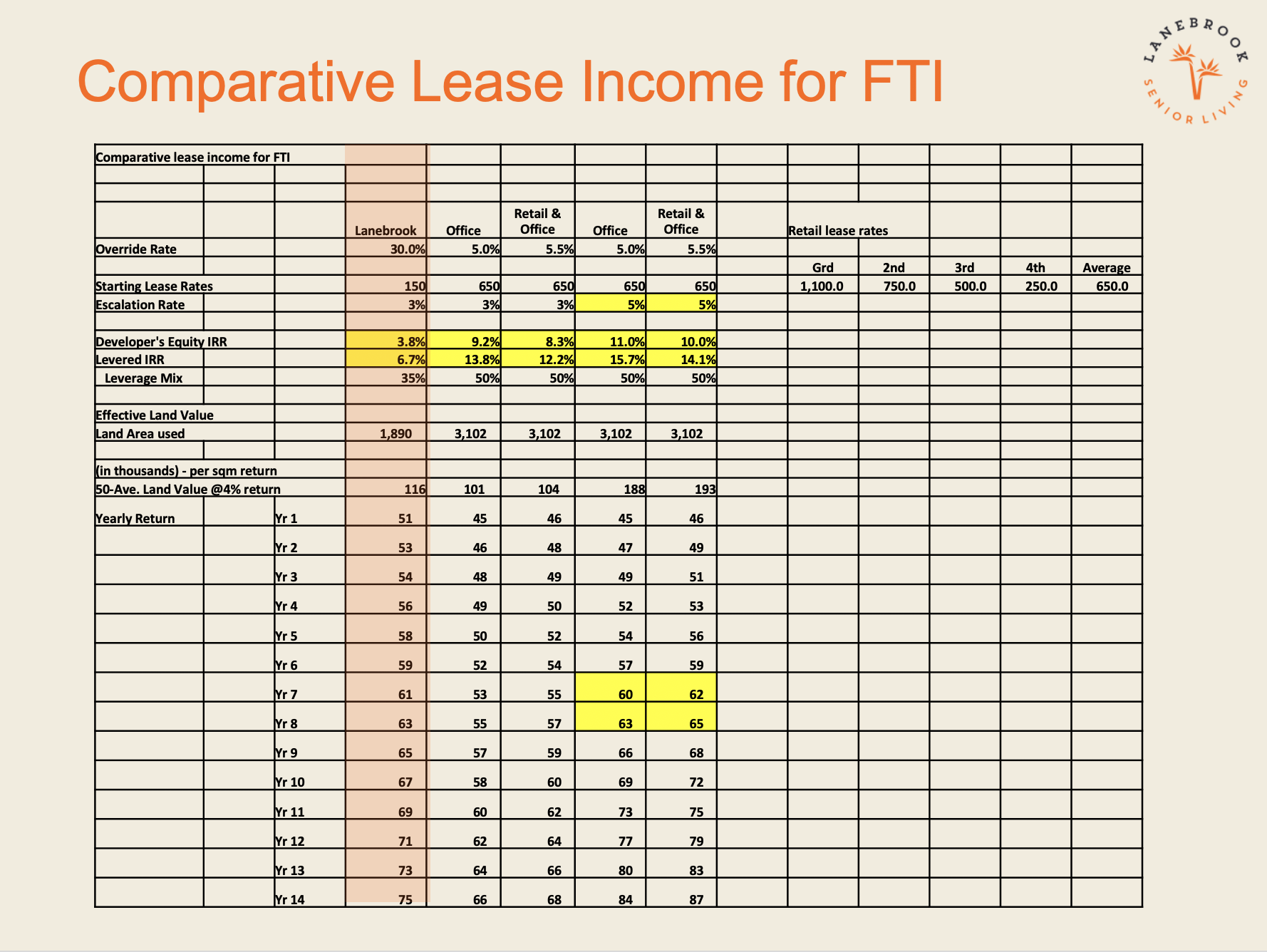

We proposed to lease the land for 50 years to commence when the first building is completed and ready for occupancy by the lessees. The offered rental rate was at 30% override on the rental income collected from our lessees, net of discounts granted, and government taxes like VAT. There will be no override share in the joining fee, membership fee, association dues, charges by association for services to be given to association members, and rental for spaces within the residential community if any.

The projected total rental income during the lease term is P2.1B for Option 1, and it will go up to P3.16B under Option 2 for the same 50 lease term. We proposed an initial Memorandum of Agreement (MOA) upon approval of this proposal for 2.5 – 3 years as we plan and aggressively market the project abroad. Upon reaching 75% lease out of the first building or the 2.5 or 3-year grace period, whichever comes first, we offered to sign a Lease Agreement with the FTI for a 50-year period. This is to make sure that we have a community at Day 1 of the project life. Should we not meet the 75% lease out rate within 2.5 – 3 years, we can cancel the MOA.

At the MOA signing, we propose to give FTI a P1m pre-development goodwill. This is equal to about 60% of the annual rent for the 100% of Admin Building at an assumed average rental rate of P190/sqm. We also propose to give P8m activation incentive for every building completed payable in 2 tranches – 1st tranche upon completion of the building and the next after one year. This activation incentive equals approximately 5-year lease income for the 100% lease out of the Admin Building under the same P190/sqm average rental rate. FTI can still lease out the Admin Building, and any rental income derived from leasing the same under both Options that we propose will be for the account of FTI.

Project Financing:

We will take out a loan from financing institutions to fund part of the development costs for the project’s financing. This will be after we met the 75% lease-out rate threshold for our project and signed the Lease Agreement with your Agency. The loan will be a vital part of the development strategy. In line with this, we would like to request acknowledgment of the lease agreement and help prepare materials for the financing institutions to help comply with their documentary requirements.

In addition, as we develop the future clusters and find retail development needed to support the project, we plan to build a portion of the area for retail development where FTI will share rent at 5% of actual rental income, net of discounts.

Date